Infrastructure equity/debt investments are illiquid and designed for investors pursuing a long-term investment strategy only, and therefore might not be suitable for investors that are unable to sustain such a long-term and illiquid commitment. This website is for information purposes only. It does not contain all information necessary to allow potential investors to take an investment decision. It does not constitute an offer or an invitation to subscribe for interests, units or shares of an Alternative Investment Fund. The information presented herein should not be relied upon, since it is not final, incomplete and may be subject to change.

This is a marketing communication. Please refer to the prospectus of the AIF before making any final investment decisions.

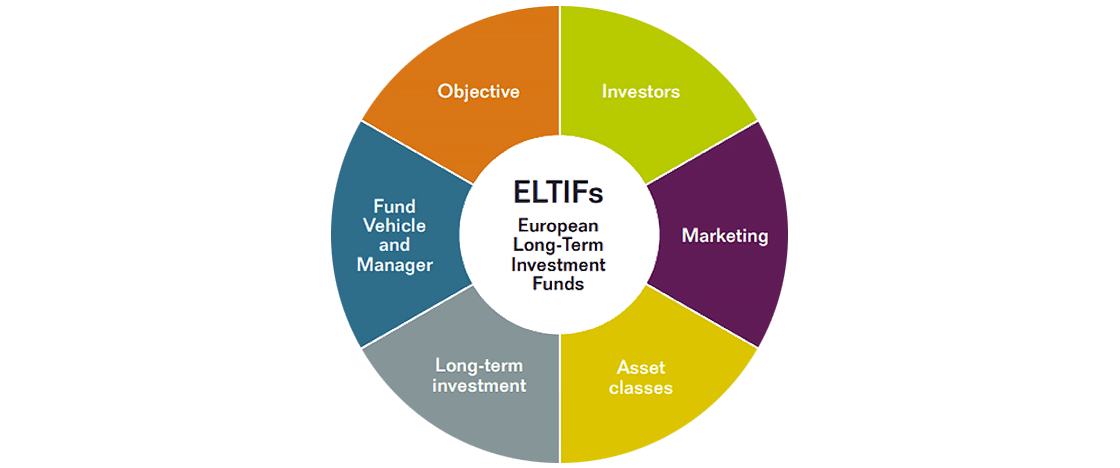

What is an ELTIF?

The term “ELTIF” stands for European Long-Term Investment Funds. It is a pan-European regime for Alternative Investment Funds (AIFs) designated to facilitate long-term investments in the real economy, such as infrastructure. ELTIFs have been around since 2015 and are intended to help guide the European economy on a path of smart, sustainable and inclusive growth.

Investing and Asset classes

• Institutional investors

• Other professional investors

• Retail investors

Where the ELTIF is offered to retail investors, additional requirements apply. In particular, a product governance process needs to be implemented and suitability requirements must be met.

EU/EEA cross-border distribution passport

Mix of long-term assets and liquid assets

– exposures to qualifying portfolio undertakings including equity, quasi-equity, debt and loans

– real assets

– units or shares of one or several other alternative investment funds (AIFs)

– certain securitisations

– green bonds

ELTIFs may also invest in eligible assets for Undertakings for Collective Investment in Transferable Securities (UCITS) such as equities, bonds and other UCITS.

At least 55% of the capital

Regulated fund vehicle and manager

A financial vehicle

Source: Association of the Luxembourg Fund Industry (ALFI), ELTIF 2.0 – the European long-term investment fund (ELTIF), What is an ELTIF,

page 4. November 2023

New rules came into force - ELTIF 2.0

- The European Union has taken a major step towards making the financial instrument more effective and enabling even more investors to invest with a long-term impact.

-

The ELTIF 2.01 regulation amends the investment scope and requirements of the initial ELTIF regulation, making it more flexible, and accessible to a broader range of investors. ELTIF 2.0 can now invest as follows:

- Global investment universe and simplified definition of "real assets"

- At least 55% eligible illiquid investments

- Fund-of-funds strategies allowed

- No minimum investment and eased regime for "de facto" open-ended ELTIFs

Investing in an ELTIF with a clear focus on Infrastructure means also participating in societal megatrends

Infrastructure assets are the backbone of society. They provide services from distributing energy and managing waste, to enabling mobility through roads and airports. There is a significant investment need to tackle a number of structural global mega trends, and these are namely the 3D's as we call them, decarbonisation, digitalisation and demographics. We see about 94 trillion2 US Dollars in global investment need by 2040. Alone in energy transition about 28 trillion2 US Dollars of capital that needs to be invested. Therefore, infrastructure investing means participating in societal megatrends, providing ample opportunities to investors.

Shaping tomorrow’s infrastructure through one of the largest infrastructure investors worldwide

We have a long history of investing in infrastructure starting in 2008 with our first infrastructure equity investment and being widely recognised in the industry across sectors and geographies. We have continuously built out our portfolio and are one of the largest global infrastructure investment managers3, managing over EUR 50 billion4 globally in direct debt/equity transactions, infrastructure funds and co-investments. Through our new strategy, we provide access to the societal megatrend infrastructure worldwide.

Why invest in Allianz Global Infrastructure ELTIF?

Infrastructure equity/debt investments are illiquid and designed for investors pursuing a long-term investment strategy only, and therefore might not be suitable for retail investors that are unable to sustain such a long-term and illiquid commitment. This website is for information purposes only. It does not contain all information necessary to allow potential investors to take an investment decision. It does not constitute an offer or an invitation to subscribe for interests, units or shares of an Alternative Investment Fund. The information presented herein should not be relied upon, since it is not final, incomplete and may be subject to change.

With the Allianz Global Infrastructure ELTIF we offer a unique strategy in infrastructure that provides investors access to the whole infrastructure universe, within one Fund. It offers access to the megatrend infrastructure through one of the largest infrastructure investment managers worldwide by...

Allianz Global Infrastructure ELTIF – Investment benefits

The Fund will invest in global infrastructure across equity and debt, giving investors access to a megatrend through one of the largest infrastructure investment managers worldwide3.

This investment strategy is recommended only for investors who have a long-term investment horizon or who do not have substantial short-term liquidity needs.

Since ELTIFs are subject to specific regulations and guidelines, it is essential to understand the Fund’s structure, risks, and investment objectives before making any decisions

Because of the long-term nature of the assets they will invest in, it may take ELTIFs up to five years to fully invest all of the available capital in the Fund. This period is called a "ramp-up period". The portfolio composition and concentration limits do not apply during this period.

How to invest in Allianz Global Infrastructure ELTIF?

SFDR Website Product Disclosure and SFDR Pre-Contractual Disclosure (PCD) Documents Allianz Global Infrastructure ELTIF

For SFDR Website Product Disclosure and SFDR Pre-Contractual Disclosure Documents, please click the link below, select a country, type “Allianz Global Infrastructure ELTIF” into search field, select the desired share class and click on “documents” in the menu:

Prospectuses and Key Information Documents Allianz Global Infrastructure ELTIF

For Prospectuses or Key Information Documents, please click the link below, select a country, type “Allianz Global Infrastructure ELTIF” into search field, select the desired share class and click on “documents” in the menu:

Source: Allianz Global Investors, 2025 based on its own research of the applicable regulatory environment.

1 ELTIF 2.0 is Regulation (EU) 2023/606 of 15 March 2023 amending Regulation (EU) 2015/760 (ELTIF 1.0) and applicable since 10 January 2024: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32023R0606

2 Figures in USD. Source: Global Infrastructure Outlook, accessed in March 2024 via Global Infrastructure Hub https://outlook.gihub.org/; numbers may not sum due to rounding. Differentiating between Rail, Roads, Ports and Airports (jointly “Transport”), Energy, Telecommunications (“Communication”), and Water infrastructure.

3 IPE Real Assets, AllianzGI ranked 9. in the Infrastructure Investment Managers Ranking 2024 Top 100 infrastructure investment managers 2024 | Magazine | Real Assets (ipe.com).

4 Source: Allianz Global Investors, as of 31 March 2025

5 Data as of 31 December 2023, unless otherwise noted. The information above is provided for illustrative purposes only and transactions identified are not intended to be, and should not be interpreted as an offer, solicitation or recommendation to purchase or sell any financial instrument, an indication that the purchase of such securities or instruments was or will be profitable, or representative of the composition or performance of your account. The transactions identified do not represent all securities purchased, sold or recommended for client accounts. See additional disclosure at the end of this presentation. The positions of transactions on this map are approximate and are not an exhaustive illustration of all investments made.

5 IPE Real Assets, AllianzGI ranked 9. in the Infrastructure Investment Managers Ranking 2024 Top 100 infrastructure investment managers 2024 | Magazine | Real Assets (ipe.com).

6 Quarterly liquidity subject to restrictions and gating, see term sheet for details.

7 The fund is disclosing under Article 8 SFDR: EU Sustainable Finance Disclosure Regulation. Information accurate at time of publishing. Investors should take into account all the characteristics and/ or objectives of the fund as described in its legal Fund documentation.

8 Infrastructure equity funds & co-investments portfolio gross IRR in EUR after management and performance fees payable to external GPs but before AllianzGI costs, investor taxes and allocable expenses at Allianz Investor level (per Q3 2024).

9 Correlation between private infrastructure equity and the MSCI World equities, expected on average over the next 10 years, based on estimates of the risklab Capital Markets Model as of 31 March 2025.

-

For professional investors only, strictly private and confidential solely for the intended recipient.

Infrastructure equity/debt investments are illiquid and designed for investors pursuing a long-term investment strategy only.

This document is not a contractually binding document or an information document required by any legislative provision, and is not sufficient to take an investment decision. This is a marketing communication. Please refer to the legal and regulatory documentation of Allianz Global Infrastructure ELTIF (the “Fund”) before making any final investment decisions.

Target return assumptions may be based on the investment team’s experience with predecessor funds, market participants and other stakeholders of the industry. Actual returns from an investment in the portfolio over any given time horizon may vary significantly from the target return assumptions. Future performance is subject to taxation which depends on the personal situation of each investor and which may change in the future.

To the extent we express any prognoses or expectations in this document or to make any forward-looking statements, these statements may involve risks. Investments in the Fund entail a high degree of risk and no assurance can be given that the investment objectives will be achieved or that investors will receive a return on their capital. Please refer to Fund legal documentation for a full description of General and Specific Risk Factors.

Actual results and developments may therefore differ materially from the expectations and assumptions made. On our part, there is no obligation to update target return assumptions and forward-looking statements presented herein.

Allianz Capital Partners may terminate arrangements made for marketing, including by way of de-notification. The Summary of Investor Rights is available in English, French, German, Italian and Spanish at Investors rights .Investing involves risks. The value of an investment and the income associated with it can go down as well as up. Investors may not get back the full amount invested. Past performance does not predict future returns. If the currency in which the past performance is displayed differs from the currency of the country in which the investor is resident, the investor should be aware that the performance shown may be higher or lower due to exchange rate fluctuations when it enters the local currency of the investor is converted. The views and opinions expressed herein, which are subject to change without notice, are the views and opinions of the issuer and / or affiliates at the time of publication. The data used come from various sources and are believed to be correct and reliable. The terms and conditions of all underlying offers or contracts that have been or will be made or concluded take precedence. This document does not contain any statements about the suitability of the investments described here for the individual circumstances of a recipient.

For investors in the European Economic Area (EEA): For a free copy of the Fund legal and regulatory documentation, and/ or further information, contact Allianz Capital Partners GmbH, either electronically or by mail at the given address. Please read these documents, which are solely binding, carefully before investing. This is a marketing communication issued by Allianz Global Investors GmbH, www.allianzgi.com, an investment company with limited liability, incorporated in Germany, with its registered office at Bockenheimer Landstrasse 42-44, 60323 Frankfurt/M, registered with the local court Frankfurt/M under HRB 9340, authorised by Bundesanstalt für Finanzdienstleistungsaufsicht (www.bafin.de). Allianz Global Investors GmbH has established branches in France, Italy, Spain, Luxembourg, Sweden, Belgium and the Netherlands. Contact details and information on the local regulation are available here (www.allianzgi.com/Info).

For investors in Switzerland: For a free copy of the offering memorandum, subscription documents and the latest annual report of the fund contact [the Swiss representative and paying agent BNP Paribas Securities Services, Paris, Zurich branch, Selnaustrasse 16, CH-8002 Zürich - only for Swiss HNWI although opted-out as professional investors] or the issuer either electronically or by mail at the given address. Please read these documents carefully before investing. This is a marketing communication issued by Allianz Global Investors (Schweiz) AG, a 100% subsidiary of Allianz Global Investors GmbH.

For investors in the United Kingdom: This is a marketing communication issued by Allianz Global Investors UK Limited, 199 Bishopsgate, London, EC2M 3TY, www.allianzglobalinvestors.co.uk. Allianz Global Investors UK Limited company number 11516839 is authorised and regulated by the Financial Conduct Authority. Details about the extent of our regulation are available from us on request. The duplication, publication, or transmission of the contents, irrespective of the form, is not permitted; except for the case of explicit permission by Allianz Global Investors UK Limited. Contact details and information on the local regulation are available here (www.allianzgi.com/Info). This document is directed only at persons who are professional investors for the purposes of the Alternative Investment Fund Managers Regulations 2013, as amended, and is accordingly exempt from the financial promotion restriction in Section 21 of the Financial Services and Markets Act 2000 (“FSMA”) in accordance with article 29(3) of the FSMA (Financial Promotions) Order 2005. The opportunity to invest in the Fund is only available to such persons in the United Kingdom and this Document must not be relied or acted upon by any other persons in the United Kingdom.

August 2024 | 3778599