Blog: As fixed income investors head for the exits in public credit markets, Trade Finance seeks to offer a better option than sitting on cash

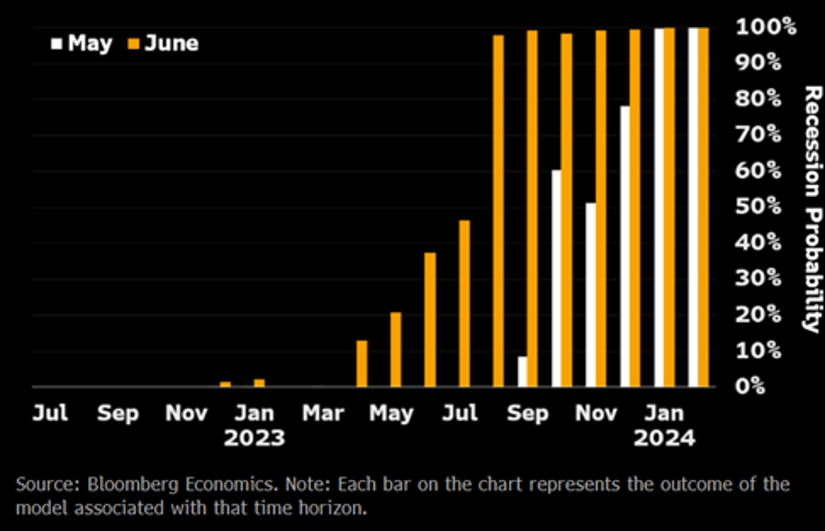

Economists are increasingly convinced that the real economy’s recession will arrive sooner than was earlier believed. In the course of one month, Bloomberg Economics has moved forward their expectations and level of confidence on the looming recession, stating that a recession by August of next year is all but certain.

Rising Risks of Earlier Recession

Meanwhile, in financial markets, investor pessimism has already translated into a bear market that is sparing few asset classes.

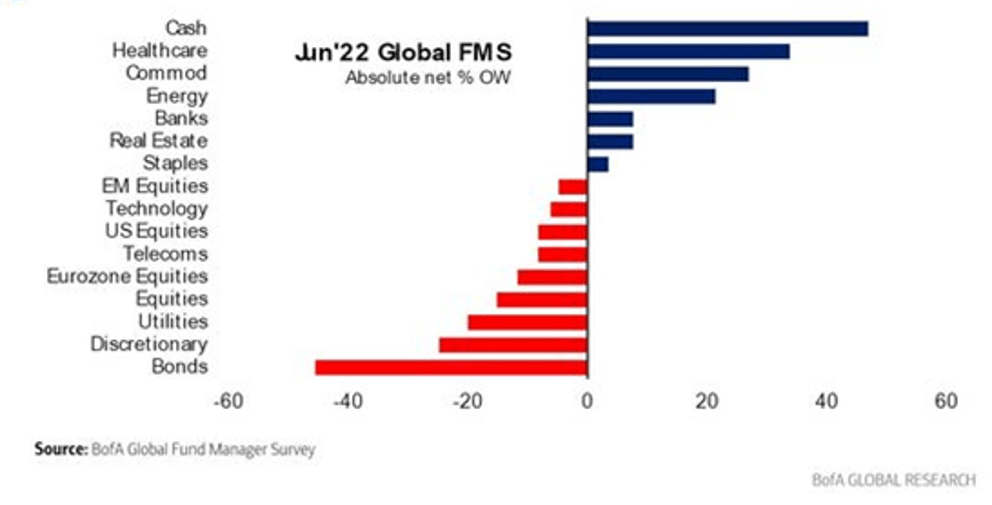

In the July edition of the Bank of America’s (BofA) Global Fund Manager survey polling investors collectively managing over $800bn, BofA summed up the mood as one of “full capitulation” as investors retreated from risk assets.

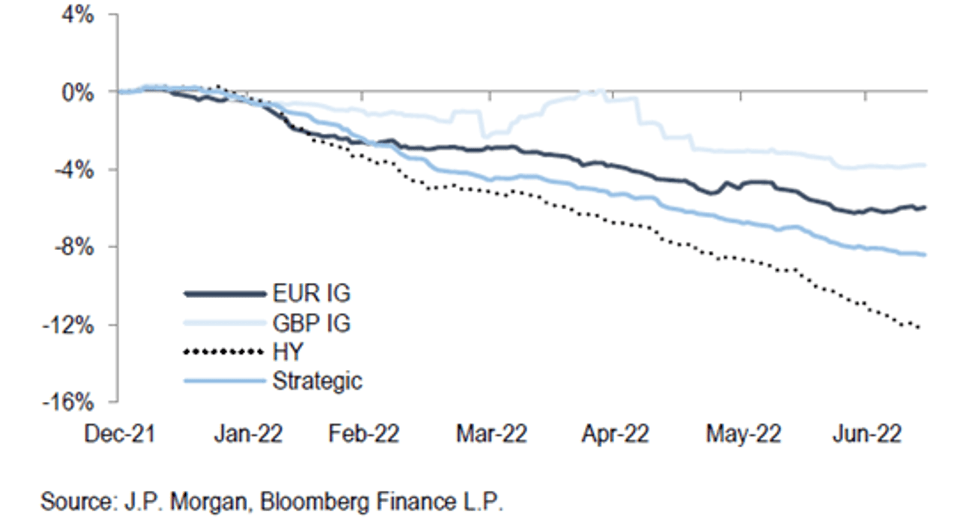

European fixed income markets have seen almost EUR 50bn of outflows since the start of the year, a meaningful proportion of the asset classes.

Despite inflation running above 9%, investors are showing most conviction for stashing cash under the mattress as they bide time for clarity on the direction of rates, inflation and growth. According to the survey, reported cash holdings were at their highest level since 2001.

FMS investors are bullish cash, healthcare & commodities.

Absolute net % OW

Cumulative from Jan 2022 Fund Flows, %AUM

The anticipation of the credit cycle’s transition toward a downturn has many institutional investors sitting on the sidelines, as tightening financial conditions will continue to hang over many segments of credit markets.

In this context, a broadening range of institutional investor client types are allocating to or researching Trade Finance as a private credit strategy.

With underlying assets having average maturities of under 120 days, it is a compelling way to maintain income generation for fixed income portfolios while avoiding medium term risks.

It is also picking up the rising short-term interest rates in the returns it delivers for investors. In the most pessimistic scenario, it also offers downside protection should default rates spike higher than expected, as trade finance benefits from lower default rates and higher recovery rates when compared to leveraged loans or bonds. Most strategies also offer monthly liquidity, meaning investors do not need to be locked into a strategy over a number of years which is proving daunting in today’s credit markets.

As inflation erodes the value of excess cash holdings investors are hoarding, it does the same to the real returns investors can deliver to fund their future retirees and policy holders. As investors look around for ways to safely navigate fixed income markets in the new market cycle, we can expect an increasing number to find answers in Trade Finance investment strategies.